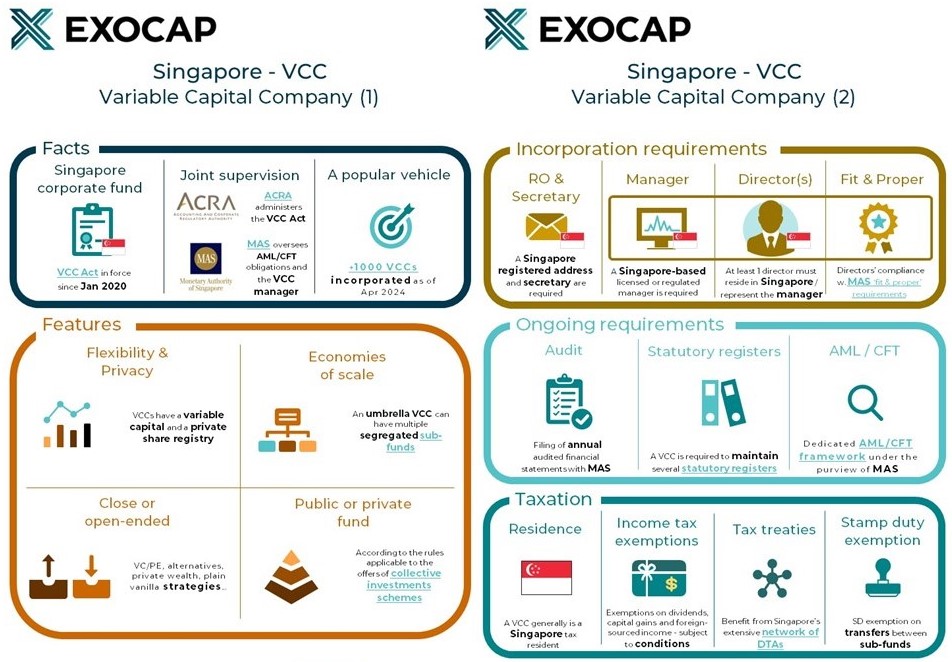

The Variable Capital Company (VCC) is a popular fund structure introduced in Singapore to enhance the city-state’s position as a fund management hub.

Inspired by other jurisdictions’ successful vehicles such as Societes d’Investissement a Capital Variable (SICAVs) and Protected Cells Companies (PCCs), VCCs have a corporate structure, a separate legal personality, and a variable capital.

They can adopt an umbrella structure where each sub-fund is treated as a separate entity with its own assets and liabilities. VCCs are generally treated as companies for tax purposes in Singapore and generally qualify for a set of tax exemptions.

They are suitable for both liquid and illiquid strategies.

Download our VCC leaflet: