UPDATED OCT 2024

Singapore is generally considered as an attractive jurisdiction when it comes to taxation.

Resident individuals are taxed on Singapore-sourced income at progressive rates (up to 24%), while companies are taxed at a flat rate of 17%. Also, Singapore does not impose tax on capital gains.

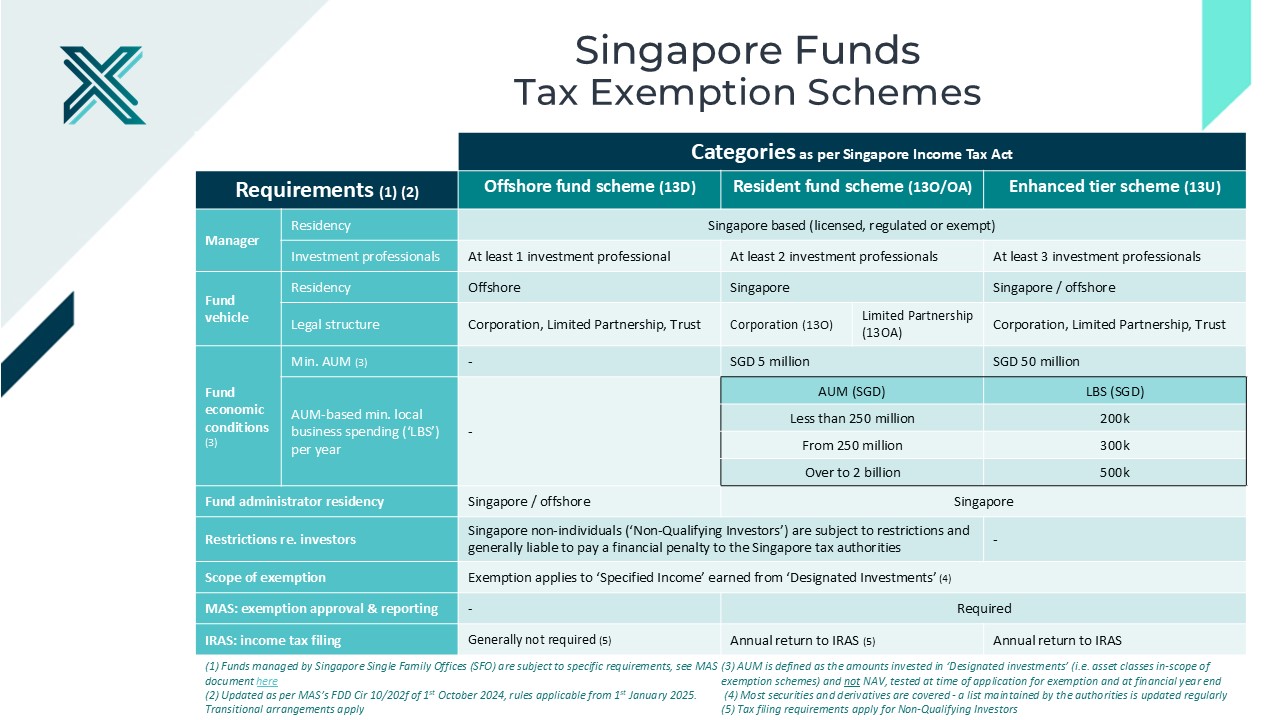

Although investment funds such as VCCs are in principle subject to Singapore income tax, the Singapore government provides various funds-specific tax exemptions schemes aimed at enhancing the attractiveness of its asset management industry (among other incentives).

As a result most Singapore investment funds are tax neutral vehicles.

These incentives are generally monitored by the Monetary Authority of Singapore (MAS) in cooperation with the Inland Revenue Authority of Singapore (IRAS).

Download our Summary of Singapore Funds Tax Exemption Schemes:

Exocap – Singapore Funds Tax Exemption Schemes – Summary – Oct 24